From the time of Aristotle to the present, people have been captivated by the topic of money. Money is a commodity that is widely acknowledged as a means of economic exchange. It serves as the main determinant of wealth and the medium through which prices and values are expressed. As a currency, it travels anonymously from one person to another and from one nation to another, allowing trade.

Modern currency is a social invention. People take money for what it is because they are aware that others will. Because of this widespread belief that money can always be exchanged for valuable items, resources, or services, everyone believes that pieces of paper are valuable.

-

Around the 18th century, paper money was introduced to India.

-

The first money printing press in India was established in 1928.

-

The RBI was founded in 1935.

M1, M2, M3, and M4 were the four monetary aggregates that the RBI used to calculate the money supply between 1977 and 1998. These are the four alternative money supply indicators that the RBI publishes data on.

M1 = CU + DD (Currency + Demand deposits)

M2 = M1 + Deposits made at Post Office savings institutions

M3 = M1 + Commercial Banks’ Net Time Deposits

M4 = M3 + any deposits made to Post Office savings institutions (excluding National Savings Certificates)

Tiny-denomination currency

With the introduction of Rs. 1 on November 30, 1917, paper money in smaller denominations was established due to the First World War.

King’s series of portraits

Starting with the Rs. 10 note in May 1923, this series featured George V’s likeness and includes the Rs. 5, Rs. 10, Rs. 50, Rs. 100, Rs. 500, Rs. 1000, and Rs. 10,000. This persisted up until 1935, the year the Reserve Bank of India was established.

Being a means of exchange is arguably the most significant function of money. Over the years, money has appeared in a variety of shapes, including cows, wheels, beads, and shells. However, all forms have always had three features in common.

What ties these different types of payment together? The three purposes of money are recognized among them:

First: Money serves as a store of value. Holding money is really a more efficient way to store value than keeping other valuables like grain, which could rot. Money is not a perfect store of value, but it is an effective one. Over time, inflation gradually reduces the value of money’s purchasing power.

Second: A unit of account is money. You can think of money as a yardstick, or the tool we use to quantify worth in business dealings. When looking for a new computer, the cost may be expressed in terms of bicycles, corn, or T-shirts. So, for example, your new computer might cost you 1000 to 1500 bushels of corn at today’s rates. Still, it is most beneficial if the price were fixed in terms of money because it is a widespread indicator of worth throughout the economy.

Third: A means of exchange is money. This indicates that accepting cash as payment is commonplace.

Introduction of CBDC

India is the world’s second most populous country with over 1.3 billion people and is also one of the fastest growing economies. In recent years, the Indian government has been looking for ways to reduce its reliance on cash and move towards a more digital economy. A central bank digital currency (CBDC) would be one way to do this.

According to analysts, the CBDC would provide the RBI with more direct control and sway over the enforcement of minimal market rules.

On November 1, the central bank launched the first trial of the digital rupee for the wholesale market, and 48 transactions totaling INR 275 Cr were recorded.

The financial and monetary system is shifting and central banks are at the forefront of those developments. They support the public’s faith in money, which opens the door to innovation. The much-awaited central bank digital currency (CBDC) would shortly commence limited trial releases, the Reserve Bank of India (RBI) stated on Friday. The pilot’s initial focus will be on particular CBDC use cases. On October 7, 2022, RBI issued a 51-page “concept note” on the Central Bank Digital Currency. It described the characteristics and function of India’s unique digital currency.

Retail Barometer for CBDC

Educating Oneself on Central Bank Digital Currency (CBDC)

It’s remarkable to see how money has changed through time, from bartering commodities for money to coins and paper money, and finally to digital currency. However, money always has the same fundamental characteristics. It acts as an accounting unit, a means of commerce, and a place to store assets.

Digital currencies and cashless societies are becoming increasingly popular as a result of the development and adoption of cryptocurrencies and blockchain technology. The usage of digital currencies that are backed by the government is therefore being investigated by central banks and governments all over the world. When and if they are approved, these currencies, like fiat money, will have the full confidence and support of the government that issued them. Despite being directly inspired by Bitcoin, the idea of CBDCs is distinct from decentralized virtual currencies and crypto assets, which are not issued by the government and lack the status of “legal cash.” CBDCs give users the ability to carry out domestic and international transactions without the use of a third party or bank.

The RBI states, “CBDC is the legal tender issued in digital form by a central bank. It is identical to fiat money and can be used interchangeably with it. Its only distinction is in form. The digital fiat currency, or CBDC, can be used for transactions through wallets that work with blockchain.

A government-issued currency known as fiat money is not backed by a tangible good like gold or silver. The exchange of goods and services is regarded as a form of recognized legal currency. The old forms of fiat money were banknotes and coins, but technological improvements have allowed governments and financial institutions to replace the tangible form of fiat money using a credit-based system where transactions and balances are digitally recorded.

So let’s start with the first and most relevant question

Why is CBDC Getting Implemented?

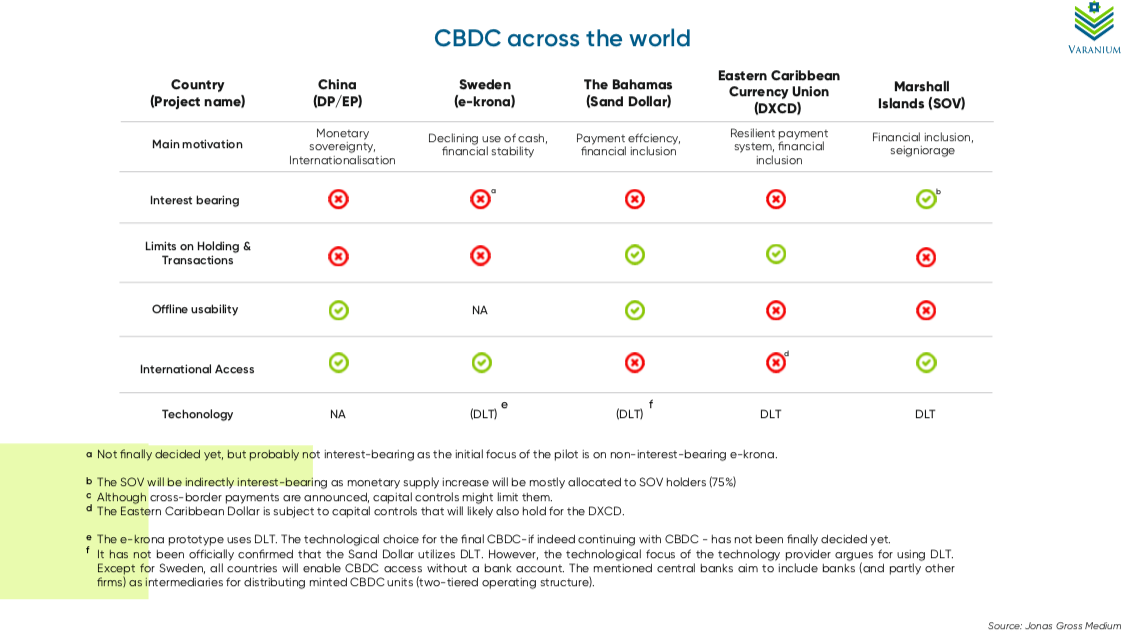

Despite the near-universal interest in CBDCs at this point, only a small number of nations have launched their CBDCs beyond the pilot stage. In a poll conducted by the BIS in 2021, it was discovered that 86% of central banks were actively examining the potential of CBDCs, 60% were experimenting with the technology, and 14% were implementing trial programs. Why the sudden fascination? The following justifications have been offered for the introduction of CBDC:-

i] In response to the declining use of paper money, central banks work to spread the use of recognized electronic money (like Sweden)

ii] Countries (such as Denmark, Germany, Japan, or even the US) with substantial physical cash usage that wants to increase the efficiency of issuing;

iii] In order to avoid the more negative effects of such private currencies, central banks work to satisfy the public’s demand for digital currencies, which is shown in the rising use of private virtual currencies.

What Type of CBDC model is to be chosen ??

CBDCs can be broadly classified into two types: general purpose (retail) (CBDC-R) and wholesale (CBDC-W), depending on how they are used and the functions they carry out as well as the varying degrees of accessibility. Every private sector business and customer who is not involved in the financial sector may use CBDC-R. Wholesale CBDCs, on the other hand, are made for regulated access by financial institutions.

As demonstrated by Project Jasper (Canada) and Ubin, CBDC-W could be utilized to increase the effectiveness of securities settlement or interbank payments (Singapore). CBDC-R issuance is anticipated from central banks that are interested in tackling financial inclusion.

In addition, CBDC-W has the ability to:

i] Improve operational expenses

ii] Usage of collateral, and liquidity management by making settlement systems for financial transactions conducted by banks in the G-Sec Segment

iii] Inter-bank market, and capital market more secure and efficient. Additionally, this might have coincidental advantages like avoiding infrastructure for settlement guarantees or the requirement for collateral to lower settlement risk.

CBDC-R: An electronic form of money primarily designed for use by consumers in stores. India already has a reliable payment system with a wide range of payment options, including RTGS, NEFT, and UPI, as well as a rapid rise in digital transactions. With the introduction of CBDC-R, a secure central bank instrument that has direct access to central bank funds for settlement and payment will be available. It is also asserted that it might increase a nation’s retail payment systems’ resilience.

When is CBDC getting implemented?

India’s finance minister Nirmala Sitharaman disclosed the CBDC project on February 1, 2022, when she presented the Union Budget 2022.

According to the Reserve Bank’s most recent announcement, pilot launches of the Digital Rupee for specified use cases have already been initiated. So, on November 1, 2022, the first trial for the Digital Rupee – Wholesale segment has taken place.

The settlement of secondary market transactions in government securities is one of the use cases for this pilot project. E-rupee adoption is anticipated to increase the effectiveness of the interbank market. By eliminating the requirement for infrastructure to support settlement guarantee systems or for collateral to decrease settlement risk, settlement in central bank money would lower transaction costs. Based on the lessons from this pilot, future pilots will concentrate on other wholesale transactions and cross-border payments.

Nine banks have been chosen to take part in the pilot, including State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank, and HSBC.

How Can CBDC Benefit You?

The central bank’s concept note emphasized the significance of finding cutting-edge approaches and compelling use cases that will make CBDC just as alluring as cash, if not more so.

In addition to other things, the note tries to clarify the CBDC’s technology, design decisions, prospective uses, and issuance methods. The effects of CBDC adoption on the banking system, monetary policy, financial stability, and privacy concerns were also examined. There will be two variations of the e-rupee. Both the wholesale and retail versions are available for use in interbank settlements. It is important to note that even though the RBI will issue digital currency, commercial banks can still disseminate it further.

Increasing India’s Financial Inclusion:

A World Bank analysis indicates that a sizable chunk of the country’s unbanked population has access to mobile phones but no bank accounts. CBDC can assist with this, according to Rahul Advani, policy director for the APAC region at Ripple, a provider of blockchain-based payment solutions. The ability to access money without having to physically go to a bank is crucial, according to Advani. A retail CBDC can be included in e-wallets to fulfill the requirements of the unbanked, giving more individuals access to formal financial services right at their fingertips.

A CBDC system, according to Advani, “would also assist the underbanked and unbanked to establish a financial identity and obtain government assistance more readily, ultimately establishing a more inclusive and equitable financial system.”

Efficient Cross-Border Payments:

For most countries, including India, cross-border payments rank among the top CBDC use cases. According to Krishnan, Indians can benefit from global prospects by utilizing the CBDC’s greater liquidity and improved cross-border, cross-currency settlement efficiency.

Reduce Money Laundering:

Since CBDC will make use of DLT technologies, such as blockchain, its utilization can be more easily monitored. Krishnan claimed that CBDC would lessen counterfeiting. According to Krishnan, the CBDC will “discourage illegal activity and strengthen anti-money laundering measures, creating more equitable possibilities for the honest, hard-working people of India.”

Pankaj Chaudhary, a state minister of finance, stated in a speech to the Lok Sabha last year that the usage of CBDC “has the potential to bring about tremendous benefits, such as reduced reliance on cash, higher seigniorage due to lower transaction costs, and reduced settlement risk.” A more dependable, efficient, regulated, and legal tender-based payment method might be produced via the usage of CBDC. He added that there are additional risks that need to be carefully weighed against the potential benefits.

Chaudhary declared that the Reserve Bank of India (RBI) had suggested changes to the Reserve Bank of India Act, of 1934, allowing it to establish a CBDC. At the time, the government intended to propose a Bill to Parliament that would, with “limited exclusions, forbid any private cryptocurrencies in India.”

“The Reserve Bank of India proposed to the government in October 2021 that the Reserve Bank of India Act, 1934, be amended to widen the term of “banknote” to encompass money in digital form. RBI has been considering use cases and creating a phased implementation strategy so that CBDC may be introduced with little to no disruption, Chaudhary told the Lok Sabha.

What Attracted Nations to Blockchain-Based Products Like CBDC?

Even though blockchain technology has been around for ten years, its use cases have lately expanded. According to a survey by Ripple titled “New Value Crypto Trends” released in August 2022, 30% of consumers worldwide think CBDC would have a significant impact on the financial sector during the next five years. According to the report, nearly 85% of consumers worldwide think their nations will legalize CBDC within the next four years. According to the survey, consumer sentiments around the world are comparable to how central banks feel.

Over 45% of consumers worldwide desire to use cryptocurrencies as a payment method in the next one to two years, according to a report named “Payments Trends Book 2022” that was released by the IT company Capgemini in December 2021. Governments are worried that private cryptocurrencies like Bitcoin, Ethereum, and others could pose a threat to the money laundering and financing of terrorism, which would put a strain on monetary policy. The Capgemini research stated that “when private cryptocurrencies gained traction, central banks started to explore and work on CBDC use cases.”

The same tendency was emphasized in an IMF blog that just went out. Since cryptocurrencies, blockchain, and other Web 3.0 goods have transitioned from being a niche market a decade ago, governments are now aware of them and are attempting to regulate them.