Imagine a farmer, weathered hands tracing furrows in the rich Indian soil, gazing up at the sky. But this isn’t just any sky; it’s a digital one, pulsating with data on weather patterns, market prices, and government initiatives. A new portal, UPAg, acts as a bridge, connecting this farmer to the knowledge and financial resources he craves. Indian agriculture, the backbone of the nation, wrestles with age-old problems. Farmers toil in the dark, lacking data on vital matters like market prices and weather patterns. Financial exclusion chains them to predatory lenders, choking their ability to invest in new technologies and better yields.

Enter UPAg, a beacon of hope rising from the digital horizon. This portal whispers promises of a data-driven future, where farmers can access knowledge and resources at their fingertips. But can UPAg, along with the burgeoning wave of Agri-fintech companies, truly bridge the data and financial divide? Is this the dawn of a new agricultural revolution in India? Join us as we delve into the potential, the challenges, and the exciting possibilities that lie ahead.

India’s agricultural sector faces a double whammy due to lack of data and financial inclusion:

Challenge #1: Data Darkness

Imagine making crucial decisions about your farm in the dark. Unfortunately, that’s the reality for many Indian farmers who lack access to essential information. This “data darkness” manifests in several ways:

- Limited weather forecasting: Farmers struggle to plan planting schedules, irrigation strategies, and harvest times without accurate weather data. Unforeseen weather events can devastate crops, leading to significant financial losses.

- Pest control quandaries: Without access to updated information on pest identification and management techniques, farmers may resort to outdated methods or overuse pesticides, harming both crops and the environment.

- Government scheme obscurity: Many beneficial government initiatives aimed at supporting farmers go unnoticed due to a lack of awareness. This hinders access to financial aid, subsidies, and other valuable resources.

Challenge #2: Financial Exclusion

A significant portion of Indian farmers, particularly those in rural areas, are excluded from formal credit channels offered by banks and financial institutions. This forces them to rely on:

- Informal moneylenders: These lenders charge exorbitant interest rates, trapping farmers in a vicious cycle of debt. This limits their ability to invest in essential resources like better seeds, fertilizers, and irrigation systems, ultimately impacting their yields.

- Limited access to loans: Formal loan applications can be complex and time-consuming, further discouraging farmers from seeking the financial resources needed to modernize their practices.

The challenges faced by Indian agriculture, as we’ve seen, paint a concerning picture. Let’s explore how these potential solutions might illuminate the path towards a more prosperous future for our farmers.

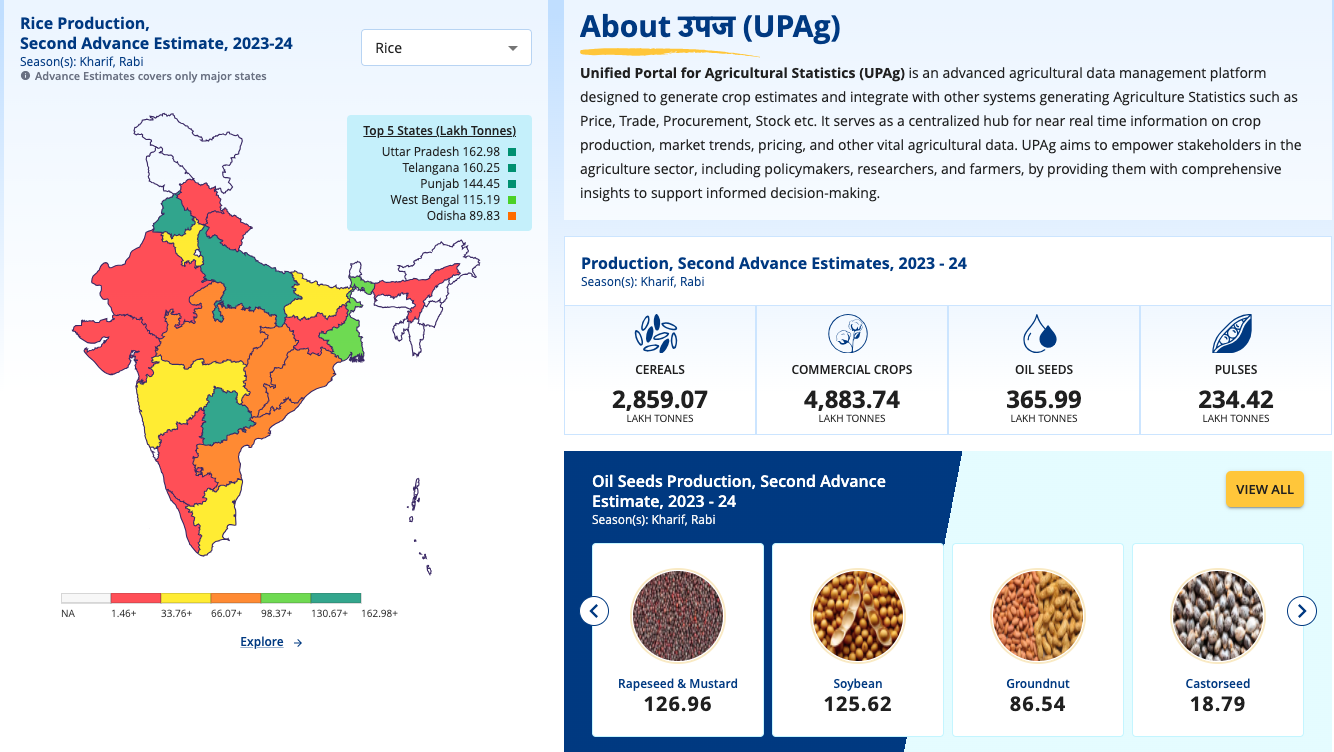

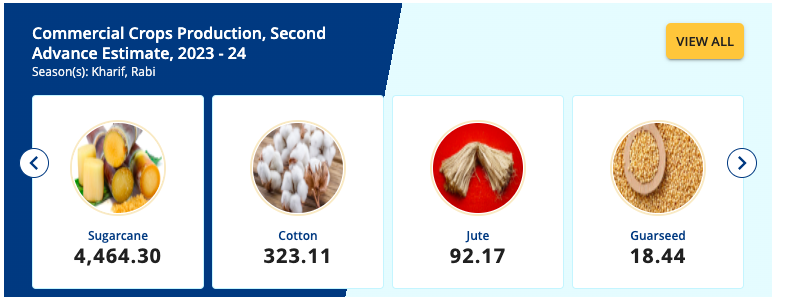

The UPAg portal, a brainchild of the Ministry of Agriculture and Farmers’ Welfare, is a game-changer in the data domain. Imagine a central hub where standardized, verified, and real-time agricultural data is readily available. This is precisely what the UPAg portal offers, fostering informed decision-making for policymakers, researchers, and all stakeholders invested in the sector’s growth.

Now, let’s talk about agri-fintech – a dynamic field where technology meets finance to address the specific needs of the agricultural sector. Think digital payment solutions that streamline transactions for farmers, crop insurance plans that mitigate risk, and microloans that provide much-needed financial support. By bridging the financial inclusion gap and enhancing efficiency throughout the agricultural supply chain, Agri Fintech is poised to empower our farmers and unlock the sector’s true potential.

Here’s a breakdown of UPAg’ key objectives :

- Standardization & Verification: UPAg acts as a central repository, consolidating data from various sources and ensuring it adheres to a consistent format. This eliminates confusion and inconsistencies that often plague agricultural data. Verification procedures ensure the accuracy and reliability of the information presented.

- Improved Access: The portal provides a user-friendly platform for farmers to access essential agricultural data. This eliminates the need to scour through disparate sources, saving time & effort.

- Data-Driven Decision making: With access to reliable information on weather patterns, market prices, pest control methods, and government schemes, farmers can make informed choices about their crops, fertilizers & investments. This empowers them to optimize their yields, minimize risks, and maximize profits.

- Enhanced Policy Formulation: UPAg provides valuable insights for policymakers. This allows them to develop targeted & evidence-based agricultural policies that effectively address the needs of farmers across the country.

Ultimately, the UPAg portal aspires to be a cornerstone of Digital Public Infrastructure for Agriculture.

UPAg: Bridging the Data Gap with Standardization, Verification, and Real-Time Updates

One of the major challenges plaguing Indian agriculture has been the lack of readily available, reliable data. UPAg tackles this head-on by focusing on three key aspects: Data standardization, verification, and real-time updates.

- Data Standardization: Imagine a farmer trying to compare weather forecasts from different sources, only to find conflicting information. This inconsistency can be detrimental to decision-making. UPAg addresses this by :

- Establishing Common Formats: The portal defines standard formats for various data types, such as weather patterns, market prices, and crop yields. This ensures consistency and allows for easy comparison of information from different sources.

- Mapping Diverse Data Sources: UPAg acts as a central hub, integrating data from various government agencies, research institutions, and private organizations. This comprehensive approach provides a holistic view of the agricultural landscape.

- Data Verification: Data accuracy is paramount for informed decision-making. UPAg employs robust verification procedures to ensure the trustworthiness of the information presented :

- Multi-Level Verification: Data may undergo verification at various stages, depending on the sources and type of information. This can involve cross-checking with established datasets, on-ground verification by agricultural experts, and employing data validation techniques.

- Transparency in Data Lineage: UPAg can provide users with information on the origin & processing steps of the data they are accessing. This transparency fosters trust & allows farmers to access the credibility of the information.

- Real-time Updates: Timely updates are crucial for farmers to adapt to changing conditions. UPAg prioritizes real-time updates for critical areas :

- Weather Monitoring Systems: Integration with weather monitoring systems allows for real-time updates on temperature, rainfall, humidity, and other weather parameters. Early warnings of extreme weather events can help farmers take necessary precautions to protect their crops.

- Market Price Feeds: UPAg can provide access to live market prices for various agricultural commodities. This empowers farmers to make informed decisions about selling their produce at the most opportune moment.

The UPAg portal isn’t just a boon for farmers; it offers significant advantages for policymakers, researchers, and all stakeholders in the Indian agricultural sector.

Here’s a breakdown of the benefits for each group :

Policymakers gain a data-driven edge for crafting effective policies. UPAg’s real-time insights on production, market trends, and resource availability allow for targeted interventions and efficient resource allocation. Additionally, UPAg facilitates continuous monitoring & evaluation of policy impact.

Researchers get a data goldmine with UPAg. This centralized repository saves time and effort, offering standardized and verified data for robust research on various agricultural topics. UPAg can also foster collaboration between researchers, accelerating advancements in the sector.

Stakeholders benefit from transparency & efficiency, UPAg provides real-time market price data, fostering a fair marketplace for everyone – from input suppliers and commodity traders to consumers. UPAg’s data empowers stakeholders with better risk management strategies & informed investment decisions, ultimately leading to a more stable & prosperous agricultural sector for all.

Core Offerings

- Digital Payments: Traditionally, agricultural transactions often relied on cash, a system prone to inefficiency and security risks. Agri-fintech companies promote secure and convenient digital payment options. This allows farmers to receive payments electronically for their produce, reducing the risk of loss or theft and ensuring faster access to their hard-earned income.

- Crop Insurance: Agricultural livelihoods are inherently vulnerable to natural disasters and unforeseen events. Agri-fintech platforms can offer various crop insurance schemes. By leveraging data analytics and remote sensing technology, these companies can assess risk factors and offer customized insurance plans to farmers. This financial safety net protects farmers from devastating losses and provides peace of mind.

- Microloans: Traditional loan application processes can be complex and time-consuming, often deterring smallholder farmers from accessing much-needed credit. Agri-fintech companies offer innovative microloan solutions. These typically involve smaller loan amounts with flexible repayment terms, catering specifically to the financial needs of farmers. Additionally, agri-fintech can utilize data analytics to assess a farmer’s creditworthiness, streamlining the loan application process and making credit more accessible.

The UPAg portal and agri-fintech companies form a powerful partnership with the potential to revolutionize financial inclusion and risk management for Indian farmers. Here’s how data from UPAg can be leveraged by agri-fintech solutions:

Enhanced Risk Assessment for Microloans:

- Traditionally, assessing creditworthiness for smallholder farmers has been challenging due to limited financial data. UPAg’s data on factors like landholding size, crop yields, and historical market prices can be utilized by agri-fintech companies to create more accurate creditworthiness profiles. This allows them to offer microloans with lower interest rates and flexible repayment terms tailored to the specific needs of each farmer.

Data-Driven Crop Insurance Products:

- UPAg’s real-time weather data and information on historical weather patterns in a particular region can be integrated with Agri-fintech’s crop insurance offerings. This allows for customized insurance plans that consider factors like a farmer’s location, crop type, and historical weather trends. This data-driven approach can lead to more affordable and effective insurance products for farmers.

Precision Agriculture through Microloans:

- UPAg’s data on soil conditions and historical crop yields can be used by agri-fintech companies to offer microloans specifically for precision agriculture practices. This might include financing for soil testing equipment, smart irrigation systems, or high-quality seeds. By enabling data-driven decisions about resource allocation, these microloans can empower farmers to optimize yields and minimize risks.

Targeted Financial Products:

- UPAg can provide insights into regional trends and specific challenges faced by farmers in different areas. Agri-fintech companies can leverage this data to develop targeted financial products like microloans for drought-resistant seeds in water-scarce regions or weather-indexed insurance schemes tailored to specific crops grown in a particular area. This ensures that financial solutions offered by Agri-fintech truly address the unique needs of farmers at the ground level.

In essence, UPAg acts as a treasure trove of valuable agricultural data. By integrating this data with their financial products and services, Agri-fintech companies can create a powerful ecosystem that fosters financial inclusion, mitigates risks, and paves the way for a more prosperous and sustainable future for Indian agriculture.

Challenges and the Road Ahead

While the potential of UPAg and agri-fintech is undeniable, some hurdles remain. Reaching every farmer, particularly those in remote areas with limited digital literacy, requires innovative outreach strategies. Additionally, ensuring data privacy and security in this digital ecosystem is paramount.

Looking ahead, the possibilities are as vast as fertile fields. Integration of artificial intelligence with UPAg data can provide even more precise recommendations. Blockchain technology can further enhance transparency and traceability in agricultural supply chains. The future of Indian agriculture is no longer shrouded in uncertainty. With UPAg and agri-fintech leading the way, a data-driven revolution is poised to rewrite the story, ensuring a prosperous and sustainable harvest for generations to come.